Columbia professor Jingyue Ju, head of the University's Chemical Biology & DNA Sequencing Department, who was an early co-inventor of the fluorescence energy transfer labeling technology that enabled the development of high-throughput DNA sequencers and many subsequent improvements, finds himself in the middle of a patent protection lawsuit that could derail the battle between some of the world's biggest pharmaceutical companies for the lead in the rapidly growing gene-mapping industry.

The "Ju Patents"

Illumina Inc, which grew into the world's leading gene-mapping company in a $1.5 billion market funded largely by research grants, was sued by Columbia University this month for allegedly infringing five patents related to DNA sequencing. According to Reuters, the complaint states that Illumina commercialized its so-called next-generation sequencing (NGS) products despite knowing about the patents, obtained between 2009 and 2012 and assigned to Columbia.

The Columbia Spectator noticed that, although each patent has several inventors, many of the patents were referred to in the lawsuit as "the Ju Patents," singling out professor Jingyue Ju for developing "next-generation sequencing." The University is seeking royalties, triple damages and other remedies; this could cascade into an intellectual property problem for Illumina. Furthermore, it could complicate Roche's $5.7 billion hostile takeover bid, as the Swiss company it attempts to buy into the sequencing industry's power position.

Illumina defends itself

Also in the Spectator article, Columbia claimed that "Illumina has manufactured, used, offered for sale, sold and/or imported into the United States" instruments or services that use the technologies claimed by the Ju Patents. A University spokesperson confirmed that the school had filed a lawsuit, but declined to comment further.

San Diego-based Illumina, the leader in genetic research equipment sales, defended itself. "We believe these claims are without merit and we will defend against them vigorously," Illumina spokeswoman Jennifer Temple said in a statement about the lawsuit.

Bad timing?

While describing the takeover battle in late January, long before the suit was filed, a Forbe's blog said that Roche had confidence that Illumina would maintain its industry lead.

Coincidentally, WSJ-online recently wrote that Roche had extended its unsolicited offer to buy Illumina, still bidding $44.50 a share. But Illumina had said the offer was "grossly inadequate." The offer is far below the $79 per share price that Illumina commanded less than a year ago.

Meanwhile, the Columbia suit could throw Roche's calculations into doubt. So, as Ju continues his research, the next 6 to 18 months will be a volatile period in the sequencing industry. The following video, posted this month on Vimeo, gives a timely introduction to Ju and his laboratory's work:

Other competitors

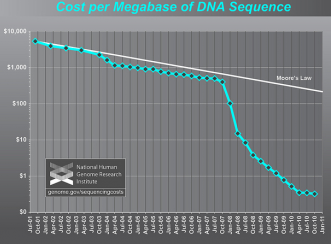

As sequencing prices rapidly drop and companies vie to personalize

patient treatment, Forbes looked at the intense competition from smaller startups. Pacific Biosciences built its own DNA sequencers with speed advantages, but failed to get much support from scientists. Another small company, Complete Genomics, offered a totally different approach, where researchers could send samples away for analysis, eliminating the need to purchase expensive equipment.

But in Forbes' opinion, Illumia's biggest competitor is San Diego-based Life Technologies, which bought Ion Torrent and its new DNA sequencer, the semiconductor-based Personal Genome Machine, selling it for only $50,000. Although it is far less powerful than Illumina's machine, the company has sold more than 900.

Recently Life Technologies made headlines by announcing plans to sell a $150,000 sequencer that they claimed would sequence a human genome for $1,000 in a day. Illumina, touting a process that offered more reliable data, announced plans for a machine that would cost $740,000.