A new, possibly longterm, economic trend emerged during 2011. Dow's Andrew Liveris, GE's Jeff Imelt, and Exxon's Rex Tillitson all think the energy landscape has permanently changed, with profound effects on the US economy.

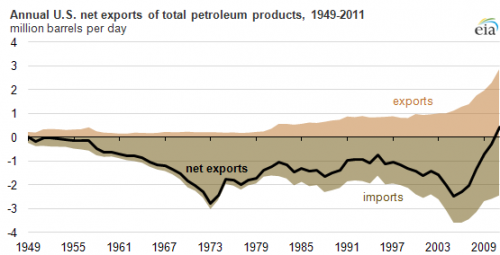

The hard news: the US began exporting more petroleum products than it imported for the first time since 1949. The key word is "products;" and the underlying concept is the yin/yang of "net exports," which have begun to take off.

Crude oil, the global jug wine

The overall picture is complicated, like a long wine list in a dimly lit restaurant. (Wine steward, please help!) While American refiners still imported large - although declining - amounts of crude (global jug wine) according to the EIA's Petroleum Supply Monthly February report, increases in foreign purchases of exported US refinery products (upscale, bottled varietals) contributed to the United States' new status as a net "petroleum products exporter."

This coincides with larger trends: a rising global population and a demographic shift toward city living for the first time in world history, all accompanied by growing affluence. Aspirational culture is spreading. India isn't manufacturing the Tata Nano for nothing. The new middle class needs an affordable runabout to impulsively pick up that trendy imported goods.

Doing the math

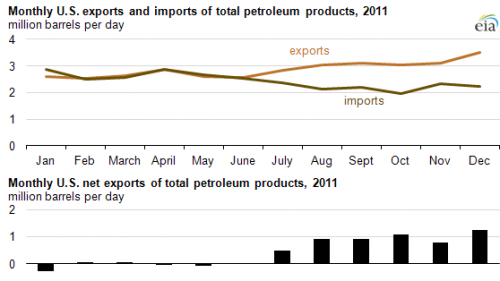

Net petroleum product exports (exports minus imports) averaged 0.44 million barrels per day (bbl/d) in 2011. Imports were at a nine-year low of 2.4 million bbl/d, and exports were at a record high of 2.9 million bbl/d.

Coinciding with rising job growth in the US oil patch, the gap between exports and imports accelerated from August through December, with total monthly exports topping 3 million bbl/day for the first time.

The Bakken formation is coming into play

With strong global demand, distillate exports, which includes diesel, had a higher profit margin for US refiners than gasoline. There is now strong evidence of the effect of increased North American oil production - particularly from Canada and from North Dakota's Bakken formation.

Overall, the US remained a net importer of crude oil, with some refined and sent overseas. These were valued second in US exports during 2011 at $111.1 billion, jumping up 60% from 2010. Last year, as the global economy continued to improve, vehicles (big ticket items like construction equipment) were the number-one US export at $132.5 billion.

Crude oil, however, was the biggest US import, valued at $331.6 billion, up 32% from 2010. Rising oil prices, rather than higher crude import volumes, however, were behind the increased value. (View the full CL00 chart at Wikinvest.)

Comments

This is a really interesting developing situation. There are a lot of things at play here as you mentioned. The US refining capacity is also running pretty tight with some potentially closing. There is the battle between the potentially dirt cheap raw material of natural gas working against the trend of not building grassroot complexes in the US - there are cracks in that wall as there have been recent rumbling about building new petrochemical complexes. The XL pipeline would likely provide more raw materials for exportable products, if it is approved. So many paradigms are shifting at the same time. It would be a terrifyingly exciting time to be in a position of deciding what moves to make in the energy business right now. Those that are bold enough and make the right moves will win big over the next decade. It would be great if the government could help take some of the uncertainty out of the equation, there has been a lot of non-decisions in the last few years that might come back and bite us. Of course, easier said than done and hindsight will still be 20/20.

Why do you think there have been so many refinery closings in the US and Europe? Not to mention the Hess factory in the Virgin Islands. Everything I read says this will bump up prices in the northeast. Congress is concerned enough to hold hearings about the situation.