The financial crisis has altered people's thinking about retirement. This report shows a shift in the responsibility of managing retirement plans from employer to employee. Pensions are already starting to be known as a thing of the past in many industries.

AIChE's biennial salary survey will be out in the June issue of CEP Magazine. In it, you'll see comprehensive data on salaries for chemical engineers. We'll be sure to post the link to this survey as soon as it's available. One of the open-ended questions asked in the survey was the following:

Has your employer made any changes to the retirement plan offerings in the last year?

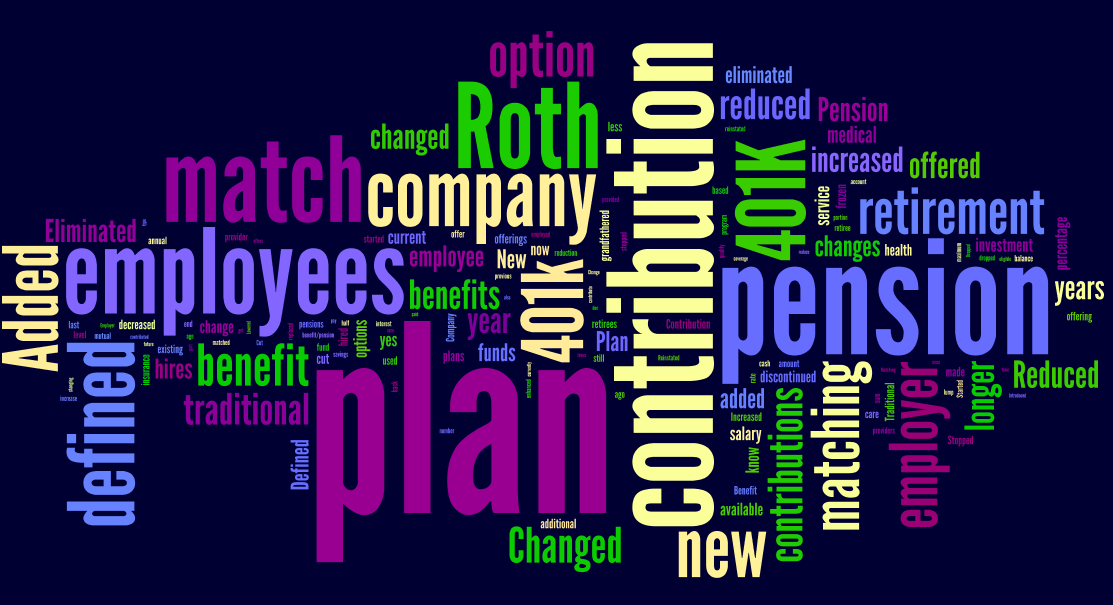

Certain trends in the word counts stood out. There were 39 mentions of the word "eliminate," 17 mentions of "cut," along with 14 and 9 mentions of the words "decrease" and "dropped" respectively. "Roth" and "add" were mentioned 86 and 88 times respectively, referencing employers adding Roth IRA options. What was most striking to me was that 10 people mentioned "don't know," "not aware," or "do not recall" with respect to their retirement plan offerings and 3 were "not sure." These may seem like relatively low numbers for these words given a sample size of more than 3,300 respondents (to the overall survey, not necessarily this question) but I think it's worth noting this lack of awareness, given current trends in retirement benefits. Here are a few noteworthy responses:

- "As of this year new employees will no longer get a defined benefit pension plan, but the plan will continue for existing employees."

- "Changed the match from 100% on 8 % to 50% on 8 %"

- "Eliminated pension and went to company matched 401K. Froze existing pensions."

- "New pensions were eliminated 5+ years ago."

Here is a wordle of the words used in the responses. You can it full size by clicking on the image or .

How do chemical engineers stack up against others? ERBI, the Employee Benefit Research Institute, publishes its Retirement Confidence Survey every year. The press release for their 2011 survey is titled Workers' Pessimism About Retirement Deepens, Reflecting "the New Normal." The survey finds that 2011 respondents are more pessimistic about retirement than any other year in the past 2 decades, which is how long the survey has been conducted. Jack VanDerhei, EBRI research director and co-author of the report states:

"To me, these are positive findings: People are increasingly recognizing the level of savings realistically needed for a comfortable retirement. We know from previous surveys that far too many people had false confidence in the past. People's expectations need to come closer to reality so they will save more and delay retirement until it is financially feasible."

You can read the entire release here. ERBI provides some great resources for employers and employees. Here are just a few:

- A Post-Crises Assessment of 401(k)s, published in the Wall Street Journal

- A 401K Help Center, offering a wealth of information on trends and tips regarding 401(k)s, 403(b)s, and other retirement saving plans.

- The ERBI blog at https://ebriorg.wordpress.com/

So, now back to the question:

Comments

Totally agreed - and there is no such thing as starting too early!