Part VI - Inventory In the previous post in this series, we talked about Operating Costs. Why does your bo$$ talk about things like inventory control when he asks you about operating costs? Inventory is the aggregate of items that are:

- Held for sale in the ordinary course of business

- In the process of production for sale

- Currently consumed in the production of goods or services to be available for sale in the future.

Since Inventory falls into the category of Assets and is reflected in the Income Statement under cost of goods sold, a shrinking or growing inventory can directly affect the bottom line. Another component of net income is the Cost of Goods Sold (COGS). In a traditional manufacturing environment, like most refineries and petrochemical plants, COGS is recorded as an expense at the time that the item is actually sold. Unsold or unprocessed items are categorized for accounting purposes as Inventory. For example, in a refinery, raw materials inventory may be natural gas extracted from the ground and stored in salt domes, or finished inventory may be mogas stored in tankage at the docks ready for shipment. What happens if the mogas is not sold and shipped out? All of the costs of producing each barrel of mogas are included in the company's Income Statement as expenses, such as cost of the raw materials (oil and catalyst), and cost of tankage are held as assets on the Balance Sheet (sometimes just called Inventory Cost). If the company had to borrow money to buy the raw materials in the first place, there is an associated Liability in a loan amount on the Balance Sheet. Inventory is bit like the idea of an electrical capacitor; it is stored money that is not easily converted to cash. So, when your bo$$ calculates the Current Ratio (discussed in a previous post), even though it is an asset, inventory is excluded from the equation. Then, when the company goes back to the bank to borrow more money for more raw materials, the Current Ratio is not as favorable and the bank may hesitate to make the loan or may choose to charge higher interest, which in turn further affects profitability.

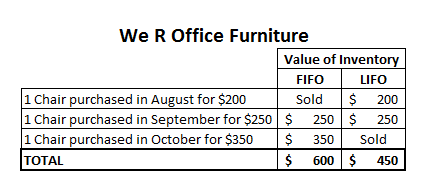

Inventory is usually valued on a FIFO- or LIFO-basis, meaning First In-First Out or Last in-First Out. This is an accounting decision of how to value the inventory that is sold and charged as an expense to Cost of Goods Sold. During a time of inflation, for example, Inventory valued at FIFO, may have reflect lower production prices and a higher profit than could be obtained today. On the other hand, the LIFO method may be overvaluing the cost of raw materials so that the Cost of Goods Sold today is higher than an average year's production costs. The attached figure shows the impact of FIFO/LIFO on inventory valuation for a retail store that buys and sells office furniture. Since the Japanese automobile industry pioneered the concepts of Just in Time (JIT) manufacturing and Lean Production, many firms maintain on-hand only the raw materials required for meeting short-term production goals. For example, a computer manufacturer may order 80 hard drives for delivery on July 1st if the firm expects to build and ship 79 computers by July 31st. Under a lean manufacturing environment, the costs of materials expenses and factory overhead costs are recognized in the same

time period as the costs occur, so the net income completely reflects the firm's profitability. Generally, inventory accounting is much simpler with a JIT system. But, what if the computer manufacturer receives an additional order for 30 computers in July? The company has only ordered parts for 80 computers and will have to delay shipment to the customer, which could cost the firm business. The choice of an Inventory valuation system (FIFO, LIFO, or JIT) can affect the taxable income that a firm pays. In many states, the government may charge the equivalent of an "inventory tax" which penalizes a company's profit and loss statement if they maintain large inventories at year end. Not to mention the amount of work to take a full physical inventory! We'll talk about taxes in our next, and final, post in this series.

What inventory issues are you dealing with?

Image of store clerk courtesy of Wikimedia Commons Image of capacitor courtesy of Flickr.com Image of computer store courtesy of Wikimedia Commons