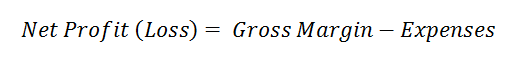

In the past few posts in this series, we have reviewed Financial Statements, like the Balance Sheet and Income Statement. You'll recall that Net Income is calculated by:

Thus, in order to increase profit (something both you and your bo$$ want to do!), we need to either increase Gross Margin or reduce expenses. Generally, gross margin (or gross income) increases as Sales increase.

To increase sales, the marketing and sales departments must either increase the number of units sold or increase the selling price per unit. Both of these are very difficult (especially in a recession!) with value-conscious customers, and even more difficult for us as chemical process engineers. For example, if you work at an ethylene plant as a process design engineer,

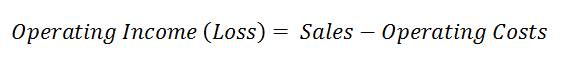

how can you directly impact increased purchases of wire and cable (one of the biggest uses for the polyethylene end product)? Most likely, wire and cable purchases are controlled by new construction, and you, as a chemical engineer, have very little macro-influence on these buying decisions. So, that leaves most process engineers facing lengthy discussions with their bo$$ on how to cut costs. Total costs and expenses involve things like Cost of Goods Sold, SG&A (Sales, General, and Administrative), and Depreciation. Cost of Goods Sold, in a continuous process operation, like a chemical plant or refinery, is often calculated on a per-pound basis. For example, if a plant produces two products (cumene and ethylbenzene, EB), the cost of benzene is allocated between the two product lines. Let's assume we consume 100,000 lbs. of benzene at a cost of $1/lb. to produce a 40:60 ratio of cumene:EB. Thus, we would allocate $40,000 to cumene as a materials cost (part of the Cost of Goods Sold) and $60,000 to EB. Similarly, if the plant incurred $8,000 of electric utility costs, we would allocate $3,200 to cumene and $4,800 to EB. This is one reason why your bo$$ worries about allocation splits and overhead costs. Of course, there are other allocation methods and these are studied in managerial accounting. One alternate is to drill down on electricity costs by examining the horsepower (hp) requirements of all the pumps on the cumene side vs. the EB side of the plant, which might be closer to 50:50. Digging deep into the actual consumption of utilities costs both the engineering and financial staff, so you have to be careful that the value of the detailed studies will outweigh the cost of the study. Depreciation is another expense that is subtracted from sales in order to calculate the operating income. Depreciation does not

actually involve any cash exchanges. When you buy a piece of equipment that has a long expected lifetime and will deliver value for years to come, it is considered to have a depreciation expense. For example, when you buy a used car, you might look up the expected value in the Kelley Blue Book. The price quoted reflects depreciation, or decreased value due to normal wear and tear, of a used car vs. a new car. The same is true for major equipment in a factory. Rather than force a large cost in the year in which it was purchased, the taxing authorities allow an organization to reduce its tax liability a little each year that corresponds to the expected wear and tear and obsolescence of the equipment. Accounting regulations change frequently but the standard methods of depreciation include:

Capital investment and the future cost of depreciation are always considerations your bo$$ will make before approving your project. In an older plant, with most of the equipment fully depreciated, each dollar of revenue nearly corresponds to a dollar of income, but when you add new equipment, your bo$$ has to now subtract the cost of depreciation from revenue, which will reduce operating income (and the end-of-year bonus your bo$$ expects). Next time, we'll discuss taxes and find that sometimes investments will reduce taxes, which in turn increases the cash flow. In the meantime, consider how depreciation might impact the brand or model of new or used car you would buy.

Do some cars "hold their value" (have lower depreciation) more than others?

Until next time...